Simplify your

business

payments

Diool, the digital platform adopted by African companies to centralize their transactions and accelerate payments

Diool’s Partners

Thanks to our partnership with the main operators, Diool facilitates

the collection of all mobile money payments for your business

Why choose Diool for your business transactions?

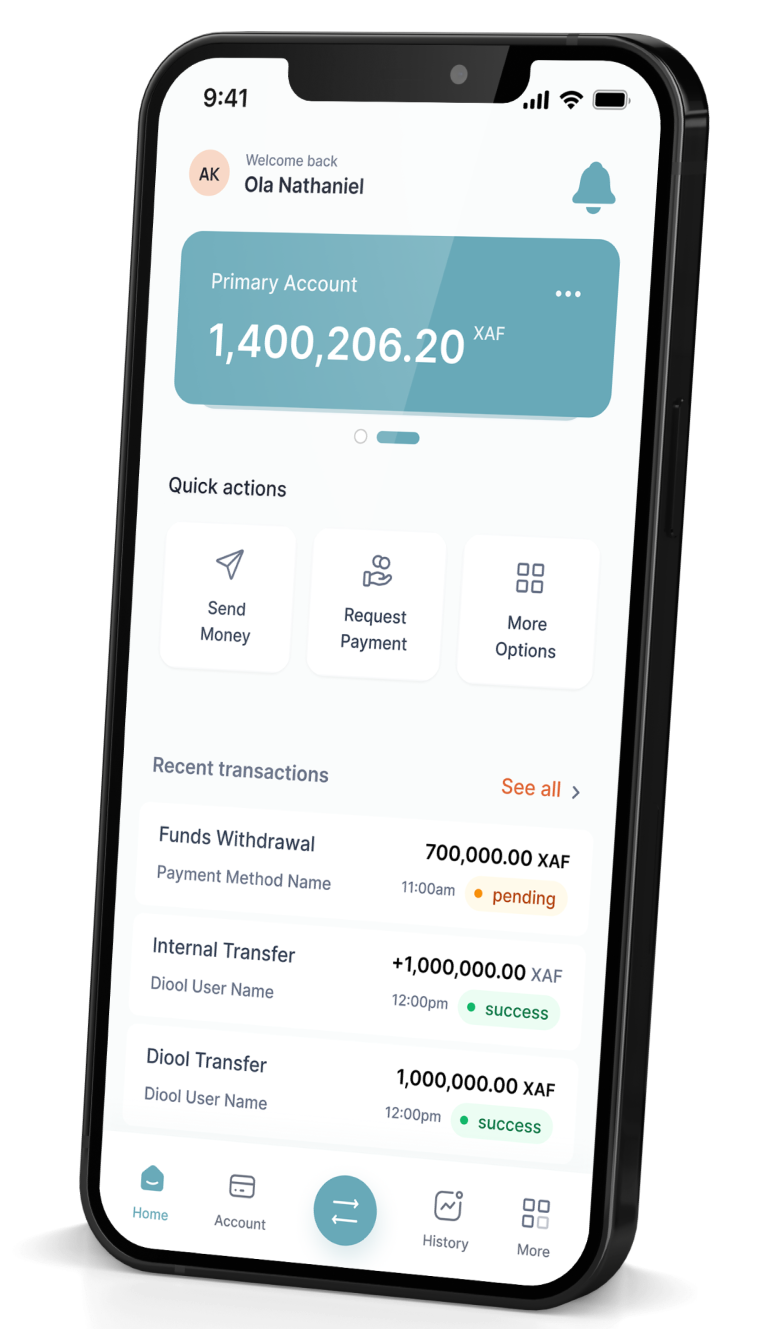

Boost your sales thanks to a new payment platform

Accept mobile money payments through one simple terminal, easy to use

- Save time by centralising all your transactions

- A modern app made to receive payments instantly

Empower your business

Reduce your cash and mobile money repatriation costs

- Quick and seamless transfers with your partners and suppliers

- Transfer to internal & external beneficiaries Diool Money, Mobile Money and Bank Transfers

- No more complex repatriation. One click to pay and get paid

Enjoy financial transparency

Keep track of your transfers, deposits, and withdrawals on the go

- One dashboard to follow your business activity

- Real time downloadable reports & detailed analysis of your payments flow

Endless possibilities for your business

Bank transfer in 2 days

From your Diool account, transfer your funds to your bank in 2 days maximum

Add & withdraw funds

Add and withdraw funds easily with any payment method

Instant payments

Pay your partners and suppliers directly from your balance

Security & compliance first

Before starting, your diool account needs to be validated by our compliance team

Constant user support

From onboarding to specific issues, customer service team is here to help you at any time

They trust us

Some clients we are working with

Our Clients Testimonials

Don’t just take our word for it: take their's!

Diool is fast, reliable and 100% secure

Sign up in just a few steps

1

Create

an account

2

Prepare

your documents

3

Fill

the form

4

Sign

electronically

5

Start

after validation*

(*) in a few days after the usual KYC verifications